Semler Scientific, a company that works with software technology for the medical sector in the United States, announced an investment of US$40 million in Bitcoin (BTC). According to documents revealed by the company, the amount resulted in the purchase of 581 BTC.

With this purchase, Semler Scientific stated that the cryptocurrency will serve as the company’s main treasury reserve asset. The strategy is the same used by companies such as MicroStrategy and the Japanese Metaplanet, which also purchased BTC.

According to Semler’s management, there was a selection process to define which asset would make up the company’s cash flow. In the end, the choice was with BTC due to its usefulness and high potential as a store of value.

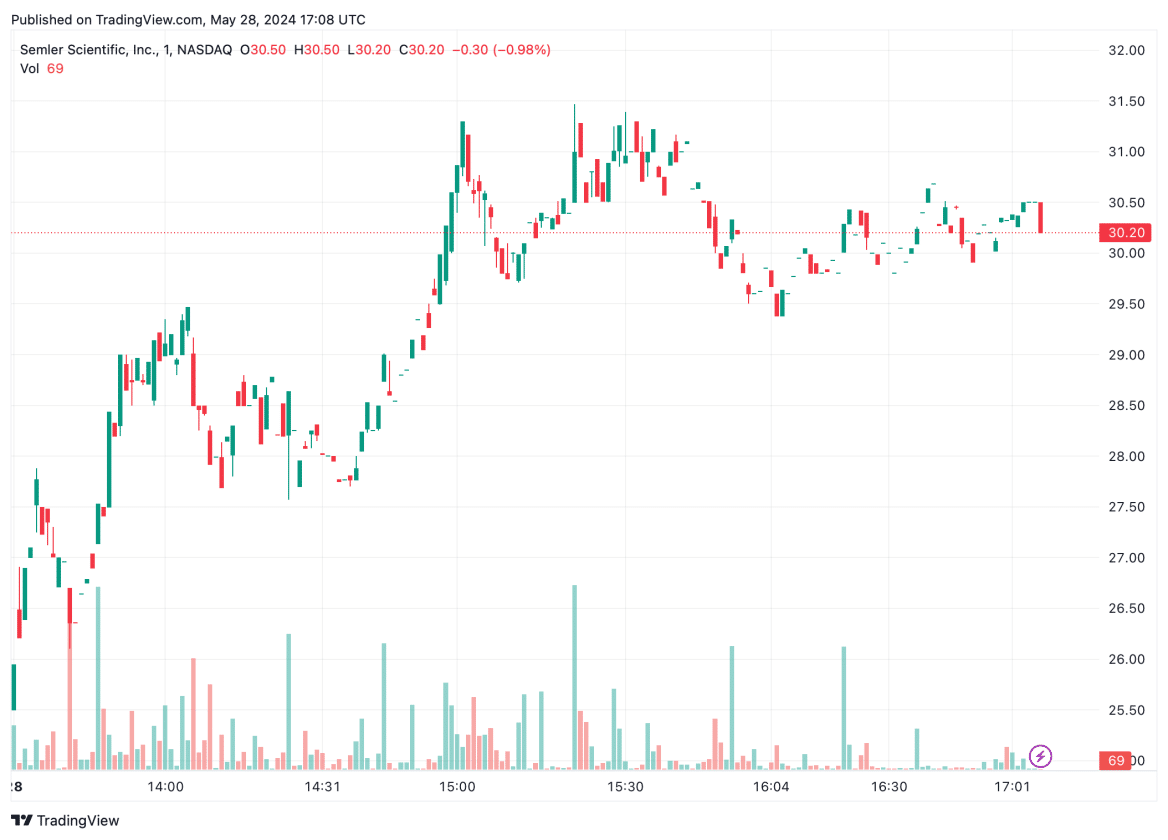

But those who really benefited from the purchase of BTC were the shareholders, as Semler (SMLR) shares rose 30% after the announcement. The share price is US$30.20 at the time of writing.

Strategy to reinforce cash

Semler Scientific’s board of directors confirmed the adoption of Bitcoin as its main treasury reserve, signaling confidence in the cryptocurrency’s stability and potential. Eric Semler, president of the company, emphasized the strategic decision.

“Our strategy and acquisition of Bitcoin as part of our treasury highlights our confidence in Bitcoin as a reliable store of value and a solid investment option,” he stated.

Additionally, Semler considers Bitcoin to be an important asset class, with a market value of over $1 trillion, supporting its potential as an investment. In this sense, Semler pointed to characteristics such as the scarcity and finite nature of cryptocurrency as unique, providing reasonable protection against inflation.

Another reason that led to the choice of BTC as a reserve asset was its digital and architectural resilience. Semler points out that BTC is superior to other asset classes such as gold. The company even considered the metal, but decided against it when it saw the superiority of BTC, said Semler.

Choose Bitcoin

Before adopting BTC, Semler Scientific spent considerable time evaluating different assets. The company extensively explored the viability of cash, US Treasury bonds and gold as alternatives, until it settled on Bitcoin.

The trend of Bitcoin adoption by large companies strengthened at the beginning of the year, when the US Securities and Exchange Commission (SEC) approved Bitcoin ETFs. The funds provided a new way for companies to acquire BTC on the market without having to directly purchase the cryptocurrency.

However, many companies still choose to acquire BTC directly because of the advantages of the cryptocurrency’s self-custody, such as security and protection against confiscation.

Interestingly, Semler’s shares reached their historic high at the same time as Bitcoin, in November 2021, when they reached US$150. However, since then, the company’s shares have registered a drop of 79%, even taking into account the rise of this Tuesday (28).

Source: https://www.criptofacil.com/empresa-ve-acoes-subirem-30-apos-compra-de-bitcoin/