The recent surge in the cryptocurrency market, driven by notable rises in Bitcoin (BTC) and Ethereum (ETH), has brought optimism among investors. Significant events, such as the approval of Bitcoin ETFs and the halving, shaped the scenario, making investors excited again.

Meanwhile, CryptoQuant founder Ki Young Ju recently shared insights based on on-chain data that point to the likely length of the bull cycle. And according to this data, this cycle could last for less than a year, ending in April 2025.

Data indicates Bitcoin cycle until April

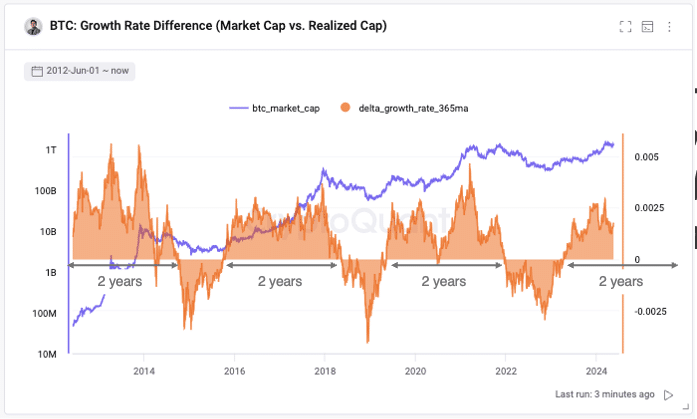

Young Ju drew attention to on-chain data showing the trajectory of BTC’s bull cycle. In his X account, the founder of CryptoQuant stated that the cryptocurrency is currently in the midst of its bull cycle, with its market capitalization surpassing its realized limit.

As he explained, this cycle began in April 2023, when the price of BTC began to appreciate. However, Young Ju said that based on historical trends, these cycles typically last about two years.

Therefore, considering the current pattern, he suggested that Bitcoin’s current bull cycle could end in April 2025. This data suggests that the cycle could end exactly one year after the halving, which occurred in April this year.

-

Analysis of the Bitcoin cycle. Source: Young Ju/X.

Typically, Bitcoin cycles culminate in the establishment of a new all-time high more than 12 months after the halving. The May 2020 post-halving cycle top, for example, occurred in November 2021, almost 18 months later.

Ju’s analysis comes at a time of positive sentiment in the cryptocurrency market, with US Bitcoin ETFs witnessing significant inflows this week. According to data from Farside Investors, ETFs recorded inflows of more than US$726 million in the last four days, reflecting the return of investor interest.

Eric Balchunas, senior ETF analyst at Bloomberg, noted that ETFs have seen inflows of $1.3 billion over the past two weeks. As a result, the market was able to compensate for previous outflows and restore confidence among investors.

Market recovers optimism

Cryptocurrency market enthusiasts appear to be regaining confidence in the digital asset space, as evidenced by the recent performances of cryptocurrencies like Bitcoin, Solana and others. This occurred after the release of the US inflation index, which grew more slowly than expected.

The data revealed a cooling in inflation in April compared to the previous month, indicating a potential change in the Federal Reserve’s (Fed) position in relation to interest rates. If inflation continues to decline, the Fed should begin cutting interest rates, which could boost the market.

However, despite the positive evolution, volatility continues to dominate the market. According to data from Coinglass, Bitcoin futures open interest fell by 1.36% in the last 24 hours, while it rose by about 1.26% in the last four hours, a strong volatility.

Source: https://www.criptofacil.com/ciclo-de-alta-do-bitcoin-deve-durar-pouco-diz-analista/