In a significant move in the world of cryptocurrencies, Grayscale, recognized as the largest crypto asset manager globally, announced substantial adjustments to its Digital Large Cap Fund (GDLC), highlighted by the removal of Cardano (ADA) from its portfolio. This announcement, made on Thursday, marks a new stage in the company’s quarterly review for the first quarter of 2024, highlighting a strategic restructuring in its asset allocations.

The company clarified that the decision to sell its ADA holdings was a crucial part of its quarterly rebalancing, with the funds reallocated to the acquisition of other components of the fund, maintaining the proportions determined by their respective weightings. This adjustment resulted in the exclusion of ADA from the GDLC, reflecting a meticulous strategy review in line with the CoinDesk Large Cap Select Index methodology.

“Every quarter, we rebalance and refresh the components of our three multi-asset funds, Grayscale Digital Large Cap Fund, Grayscale DeFi Fund, and Grayscale Smart Contract Platform Ex-Ethereum Fund,” Grayscale stated. This adjustment process aims to optimize the portfolio by replacing ADA with other large-cap digital assets while maintaining a strategic and diversified balance.

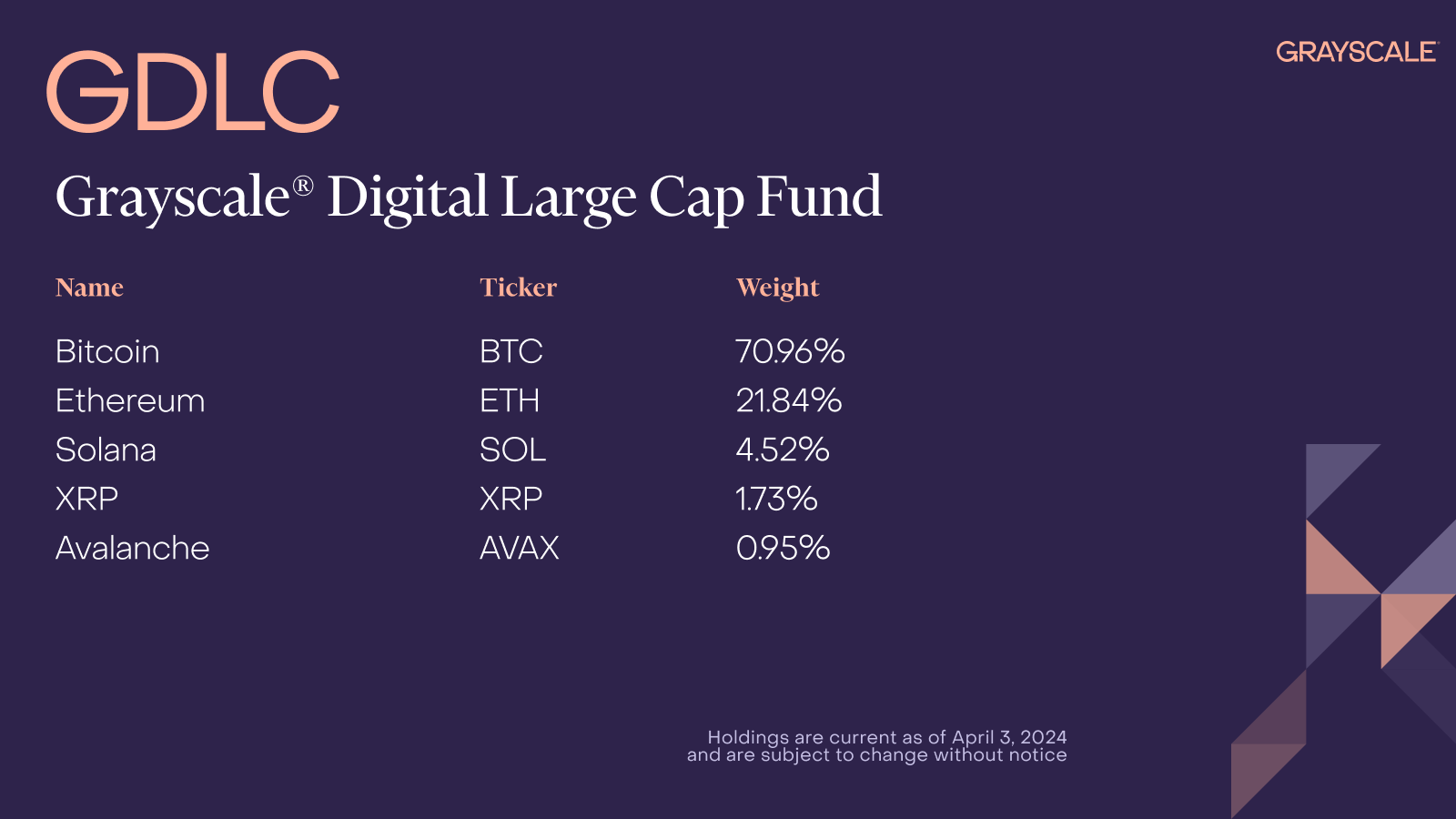

Currently, GDLC incorporates leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP and Avalanche (AVAX), reflecting a composition adjusted to efficiently represent the value of the digital assets under its management. This adjusted portfolio follows a previous modification that had already seen the exclusion of MATIC from Polygon, with the inclusion of new assets such as AVAX and XRP.

GDLC positions itself as a pioneering investment vehicle dedicated exclusively to managing a selection of large-cap digital assets. According to Grayscale, the fund’s objective is to replicate the value of its subordinate digital assets, simplifying the process of investing in cryptocurrencies for its investors by eliminating the complexities associated with their direct acquisition and storage.

This recent change in strategy, removing ADA from GDLC’s portfolio, highlights a positioning review for Grayscale, considering ADA was added to the fund in 2021 as the third-largest holding. Despite its dominance in institutional cryptocurrency investment management, Grayscale and other market players continue to adapt their portfolios in response to regulatory dynamism and emerging opportunities in the digital asset sector.

At the time of the announcement, ADA was facing a period of price stability after a week of volatility, trading at US$0.59, up 2% in the last 24 hours.

Disclaimer:

The views and opinions expressed by the author, or anyone mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing in or trading cryptocurrencies carries a risk of financial loss.

Source: https://portalcripto.com.br/grayscale-exclui-cardano-de-seu-portfolio-de-grande-capitalizacao/