Ethereum (ETH) once again faced strong selling pressure and fell 7.3% this Tuesday (2). After a rally last week that surpassed $3,600, ETH is under the control of sellers.

With the recent drop, ETH fell below $3,400 and lost crucial support. According to analysts, this loss could lead to further drops of more than 10%, causing ETH to test the $3,000 support.

Loss of support and drop to $3,000

As analyst Ali Martinez explained, ETH’s fall below the critical support level of $3,460 brought more concerns to the market. At the time of writing this article, one ETH is worth US$3,305, a price well below the already lost support.

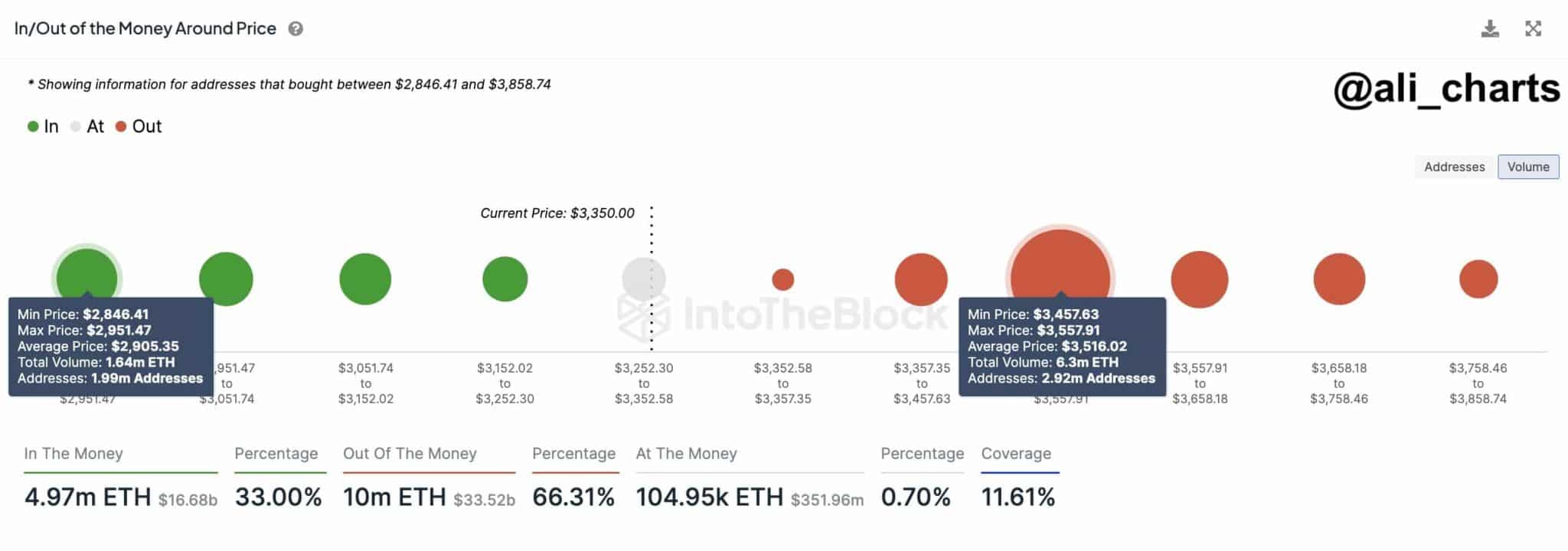

With the absence of robust support at this level, the likelihood of a continued correction in Ethereum’s price trajectory towards $2,850 or even lower becomes more pronounced. According to the image below, the flow of money into ETH up to the $2,900 level is less than the flow out.

On the other hand, QCP Capital reported notable activity over the last 24 hours, particularly in the area of options trading for Ethereum (ETH). This growth occurred especially in sales options.

As a result of this increase in options trading activity, ETH is experiencing downward pressure on its spot price in addition to high levels of implied volatilities. Specifically worth noting is the increased demand for puts compared to calls on the front-end of Ethereum options.

ETH Analysis

On the upside, immediate resistance is around the $3,400 mark, which coincides with the 23.6% Fibonacci retracement level of the recent downward move from the $3,654 high to $3,324 low.

A significant resistance level awaits around $3,420, aligning with both the trendline and the subsequent hurdle at $3,450. Breaking above this level could lead to a test of the 50% Fibonacci retracement level of the aforementioned downward move.

On the other hand, major resistance lies in the $3,520 region along with the 100 hourly Simple Moving Average (SMA). A successful break above this level could pave the way for bullish momentum.

In this sense, Ethereum’s on-chain indicators have shown strength. Ethereum addresses greater than zero have reached a new all-time high in recent weeks. In other words, there are new investors entering the market.

Source: https://www.criptofacil.com/preco-do-ethereum-pode-cair-para-us-3-000-com-perda-de-suporte/