The United States Securities and Exchange Commission (SEC) took a significant step forward by clearing the 19b-4 filings of eight spot Ethereum exchange-traded funds (ETFs) on Thursday (23). Among those benefiting from the decision are big names in the financial sector, such as BlackRock, Bitwise, Grayscale, Van Eck, Ark 21Shares, Fidelity, Franklin Templeton and Invesco Galaxy.

This approval caught many analysts and investors by surprise. This is because in recent weeks the SEC did not give many indications that it would approve ETH ETFs. But that changed quickly in the days leading up to approval.

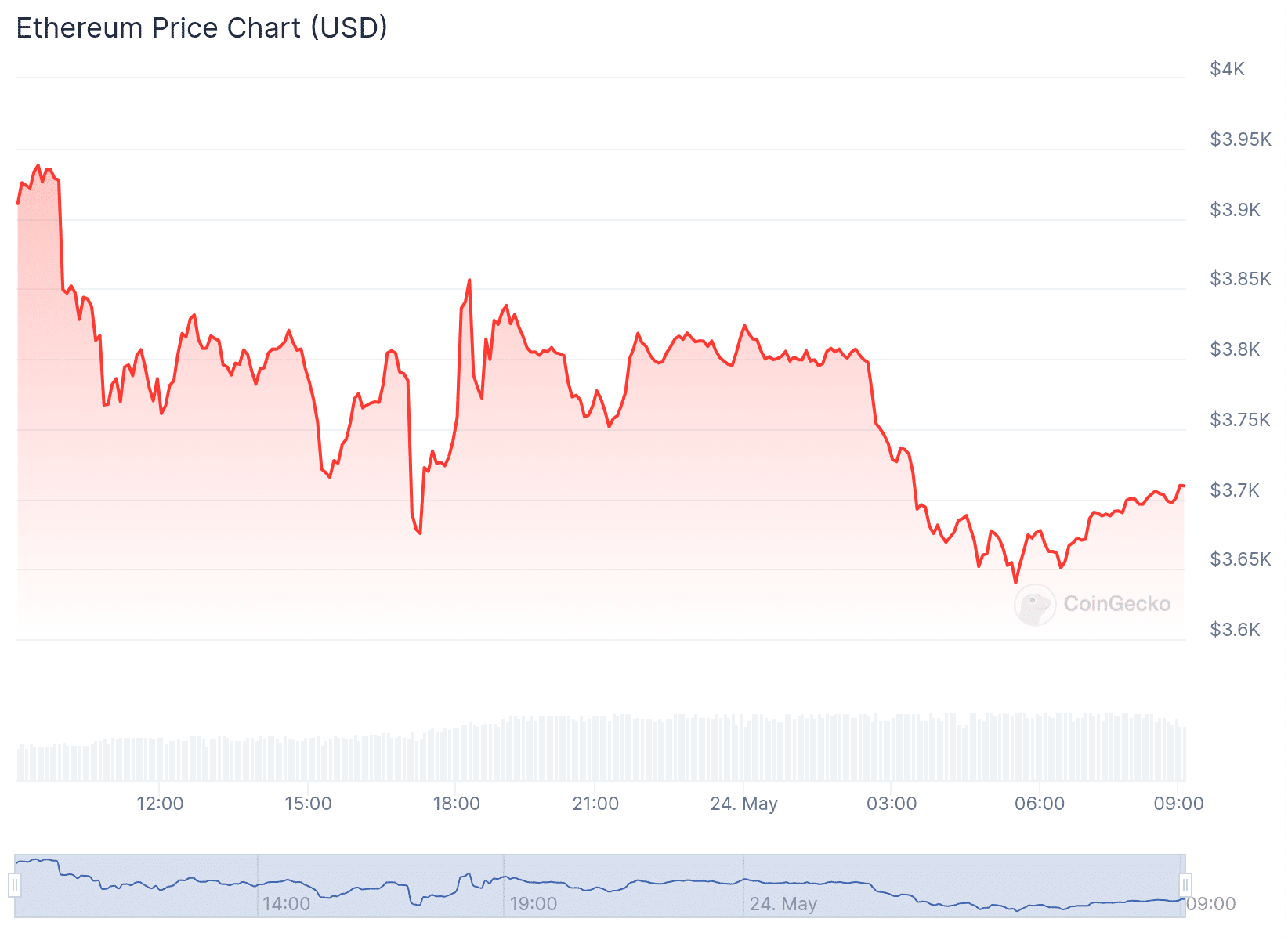

Before approval, the price of Ethereum showed a significant increase of 30% in just two days. This upward movement was driven by investors’ expectations regarding the update of 19b-4 registrations, required by the regulator before the May 23 deadline.

However, despite the initial euphoria, the price of Ethereum corrected rather than appreciated. According to data from CoinGecko, at the time of writing this article, ETH is costing US$3,700. In the last 24 hours, the second largest cryptocurrency on the market registered a drop of more than 5%.

Ethereum does not soar after ETF approval

Market experts point out that the modest price reaction can be attributed to the fact that the approval of 19b-4 filings does not guarantee immediate spot trading of Ethereum ETFs.

That’s because the SEC still needs to approve S-1 documents, which are the initial filings detailing issuers’ management of funds. This process can take weeks or even months, delaying the entry of ETFs into the market.

19b-4 filings are essential for exchanges to obtain regulator approval before listing new products for trading. On the other hand, S-1 forms provide crucial details about the structure and management of the proposed funds. Therefore, the combination of these documents is essential for the final approval and subsequent trading of spot ETH ETFs.

Some market participants suggest that the recent rise in the price of Ethereum already reflected the expectation of approval of 19b-4 filings. This way, true price action can only occur when ETFs actually start trading.

The cryptocurrency trader known as “@DaanCrypto” highlighted that around $200 million worth of orders above the current ETH price on Binance were withdrawn, indicating that large investors, or “whales,” may have suppressed prices on purpose.

In addition to the financial impact, the approval of spot Ethereum ETFs has a significant political dimension. Jesse Pollak, creator of Base, emphasized in X that the interest in ETH ETFs is not just about the price, but also about the positive message that cryptocurrencies can convey as a beneficial technology.

Pollak highlighted the importance of continuing to promote this narrative to gain more momentum and acceptance in the market.

Source: https://www.criptofacil.com/por-que-ethereum-nao-esta-subindo-apos-a-aprovacao-dos-etfs-de-eth/