In a setback for banking efficiency often taken for granted, customers of financial giants such as JPMorgan Chase, Bank of America and Wells Fargo faced an atypical reality: Accounts that should reflect recent deposits remained unchanged or showed a balance well below expectations. This episode highlighted the underlying infrastructure which, despite being robust, is not immune to setbacks.

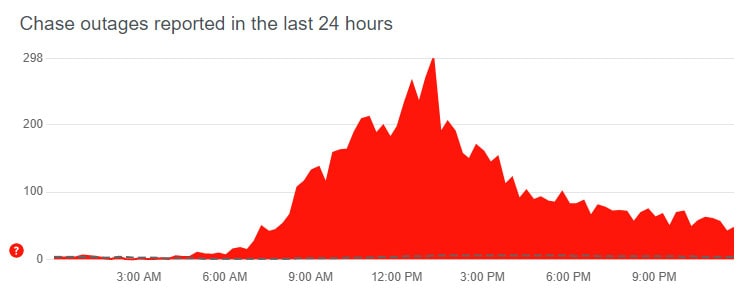

Reports about the mysterious disappearance of funds emerged en masse, accompanied by a sharp increase in complaints on platforms such as Downdetector, which signaled widespread outages at several banking institutions. The situation caused a torrent of concerns among consumers, accustomed to the agility of digital transactions.

The root of the problem was identified as a processing flaw in the Automated Clearing House (ACH), an essential network for the movement of capital that permeates the United States banking system. Managed by the Federal Reserve Banks, this network is the backbone for electronic payments, including direct deposit of wages.

Although the Federal Reserve announced that the technical glitch had been resolved, the consequences of the error continued to reverberate, with a significant volume of pending transactions awaiting processing. Financial institutions are struggling to manage the backlog, trying to mitigate their customers’ anxiety.

Communications from banks to their consumers have sought to convey security and commitment, highlighting the prioritization of correcting delays and the guarantee that balances will be restored as soon as possible. However, this incident highlights the complexity and vulnerability inherent in traditional financial systems, elements that are often questioned by cryptocurrency advocates.

This setback in banking systems could be a moment of reflection for many about the dependence on centralized structures and the search for more resilient alternatives, such as the solutions offered by the cryptoactive market.

Disclaimer:

The views and opinions expressed by the author, or anyone mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing in or trading cryptocurrencies carries a risk of financial loss.

Source: https://portalcripto.com.br/bancos-dos-eua-enfrentam-interrupcao-no-processamento-de-depositos-e-clientes-aguardam-solucao/