Michael Saylor’s MicroStrategy (MSTR) long-term buy-and-hold Bitcoin (BTC) strategy appears to be paying off. With the cryptocurrency’s most recent rise, the BTC enthusiast’s company accumulates an unrealized profit of US$1.1 billion. In other words, more than R$5.4 billion at the current exchange rate in reais.

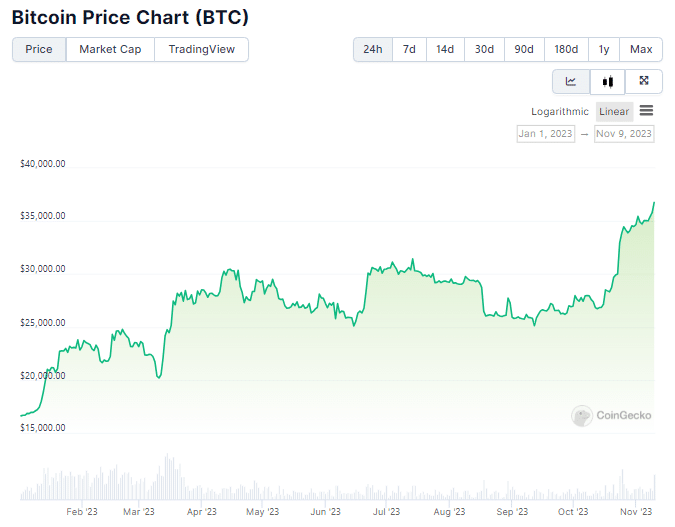

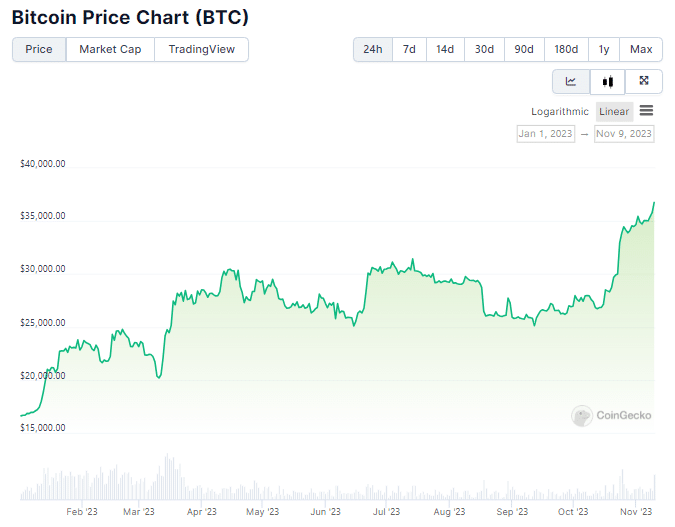

Driven by the excitement surrounding a possible approval of a spot Bitcoin exchange-traded fund (ETF), the largest cryptocurrency on the market is up more than 120% so far in 2023. The price of BTC has risen from $16,615 on Jan. 1 to the current price of $37,100, according to data from CoinGecko.

How much did MicroStrategy profit from Bitcoin?

It is worth mentioning that MicroStrategy has been purchasing Bitcoin for its reserves for about 3 years and currently has a total of 158,000 Bitcoins. This is the largest amount of BTC owned by a publicly traded company.

The company’s Bitcoin holdings reached $5.7 billion on Thursday night (09), when the price of BTC surpassed $37,000 for the first time since May 2022.

The value of MicroStrategy’s holdings is now equal to more than 80% of the company’s $7.1 billion market cap, according to data from Bitcoin Treasuries.

By way of comparison, the company that owns the most Bitcoin after MicroStrategy is the mining company Marathon Digital, with 13,726 BTC. In other words, Saylor’s company has 10 times more Bitcoins than the second largest holder of the cryptocurrency. Next come Tesla (9,720 BTC) and Coinbase Global (9,480 BTC).

BTC Buying Strategy

The most recent purchase of BTC from MicroStrategy occurred at the beginning of November. At the time, as reported by CriptoFácil, the company acquired another 155 Bitcoins for its portfolio. In total, MicroStrategy has added 6,067 Bitcoins since the end of the second quarter of this year.

Andrew Kang, the company’s chief financial officer, assured that the company will continue to make Bitcoin purchases in the future, demonstrating a strong commitment to this strategy:

“Our commitment to acquiring and holding Bitcoin remains strong, especially against the backdrop of potential greater institutional adoption. And as we continue to grow our strong balance sheet, our third quarter operating results and total revenue growth reflect the resilience of our software business,” he said.

MicroStrategy’s quarterly report reveals that, considering all Bitcoin purchases to date, the average price per BTC was $29,582.

Source: https://www.criptofacil.com/microstrategy-lucra-us-11-bilhao-com-alta-do-bitcoin/