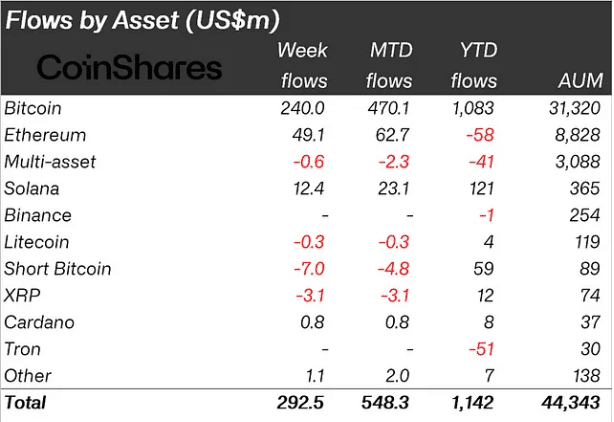

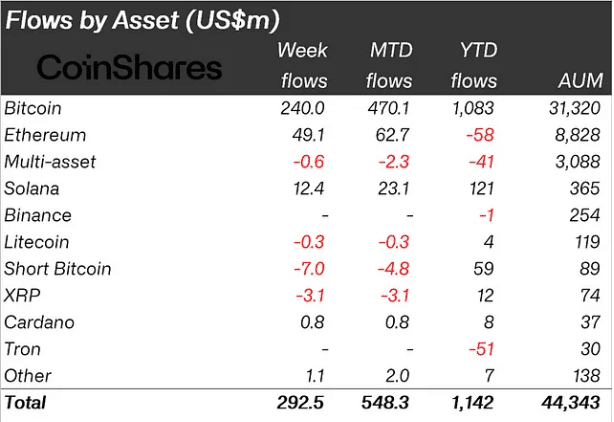

The recent rise in cryptocurrencies continues to boost investments in crypto products. According to the most recent report from digital asset analytics firm CoinShares, last week crypto investment products saw inflows totaling $293 million.

That brings this most recent series of 7-week entries past the $1 billion mark. In the year to date, investments in cryptocurrencies exceed the US$ 1.14 billion mark. As CoinShares pointed out, these are the third largest annual inflows ever recorded.

Also according to the report, total assets under management (AuM), as a result of these inflows and the recent price appreciation, increased by 9.6% in the last week and 99% since the beginning of the year. At $44.3 billion, total AuM is now the highest since the major cryptocurrency fund failures in May 2022, when the Terra (LUNA) ecosystem collapsed.

CoinShares also noted that Bitcoin ETP trading volumes represented 19.5% of total Bitcoin trading volume on trusted exchanges. This has rarely happened and suggests that ETP investors are participating much more in this recovery compared to 2020/21.

Investments in cryptocurrencies grow

Bitcoin recorded inflows totaling $240 million last week, bringing year-to-date inflows to $1.08 billion. While Bitcoin short products (which invest in the cryptocurrency’s decline) saw outflows of $7 million, indicative of continued positive sentiment.

Meanwhile, Ethereum (ETH), which ended a downtrend the week before last, saw its biggest inflows since August 2022 at $49 million. CoinShares highlighted that the last two weeks have been good for the second largest cryptocurrency on the market, signifying a real turnaround in investor sentiment.

This movement is likely related to the recent request to list an ETH spot-based ETF (exchange-traded fund) in the US. As reported by CriptoFácil, the largest asset manager in the world, BlackRock, submitted the aforementioned request in the state of Delaware. The order pushes the price of ETH above the $2,000 mark, above which ETH remains today.

Still on altcoins, CoinShares reported that Solana (SOL) also recorded new inflows totaling US$12.4 million in the last week and Cardano (ADA) saw inflows of US$800,000. However, the other cryptocurrencies registered outflows, with emphasis on XRP with -US$3.1 million.

Finally, the company highlighted that blockchain-focused stock ETFs reached $14 million in inflows. This is the highest volume since July 2022, and the value increases the accumulated flows for the year to the positive mark of US$ 11 million.

Source: https://www.criptofacil.com/entradas-em-produtos-de-criptomoedas-ultrapassam-us-1-bilhao-em-2023/