The virtualization of daily life means that income is also virtualized and, therefore, that payments to the Treasury -the income statement- must also consider these new sources of income.

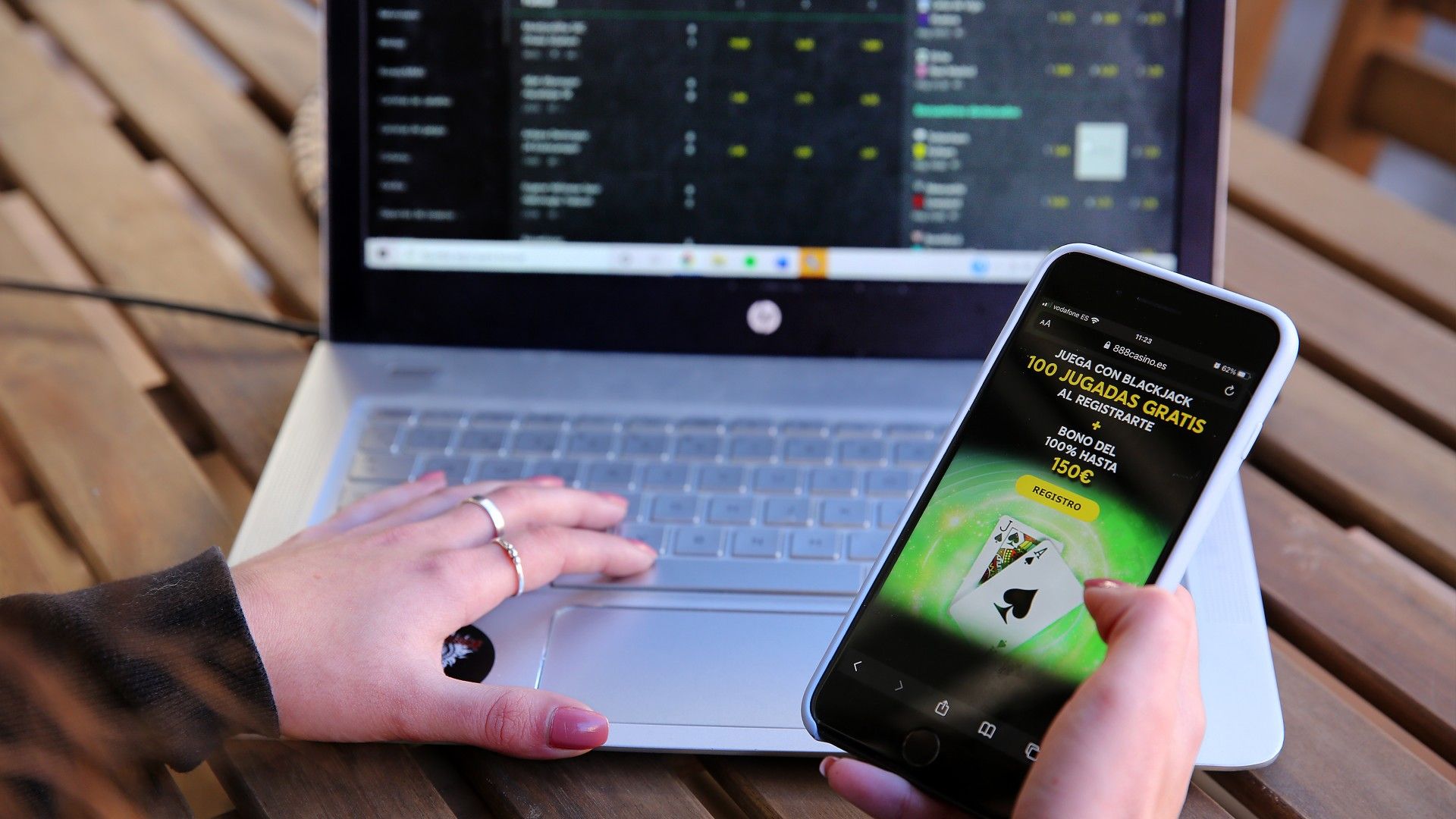

Income options include: sports bets and others gambling. LThe income obtained in this area is considered for tax purposes as capital gainsone of the five sources of income considered in the personal income tax return.

However, not in all cases it must be included in the declaration. In general, they apply the following assumptions to determine if income should be reported:

-

When an annual profit is obtained greater than 1.600 euros, generally.

-

When an annual profit is obtained greater than 1.000 euros, as long as income from work is received for an amount greater than 22,000 euros, or 14,000 euros in the case of having several payers throughout the year.

In case of not declaring this income and having to do so, the fine for failing to comply with the tax obligation can reach up to 100% of the profits obtained. The Tax Agency has the capacity to detect these non-compliances by crossing the income corresponding to each taxpayer.

Related news

The box to take into account in this area is the 290 of the income statement, which will result in the difference between gains and losses (boxes 282 and 287).

It should be remembered that personal income tax is a progressive tax, so that in its global computation will be taxed in tranches, as follows:

-

From 0 to 12,450 euros: 19%

-

From 12,450 to 20,200 euros: 24%

-

From 20,200 to 35,200 euros: 30%

-

From 35,200 to 60,000 euros: 37%

-

More than 60,000 euros: 45%

Source: www.elperiodico.com