With the week almost over, the market opened higher again this Friday (10), especially in the case of Ethereum (ETH). The cryptocurrency soared 9% in the last 24 hours and broke the $2,000 barrier for the first time since April 14. In Brazil, the price of the cryptocurrency opened the day at R$10,375, up 11%.

The price of Bitcoin (BTC) initially opened the day falling, but soon turned positive. At the time of writing this text, the cryptocurrency is up 1.1% and has once again surpassed the US$37,100 barrier. The price on the national market also increased by 1.1% and reached R$183 thousand.

As was the case for much of the week, the Top 10 cryptocurrencies opened the day practically rising. On the negative side, only XRP and Dogecoin (DOGE) recorded negative performance. XRP fell 4.7%, while DOGE registered a drop of 1.2%. Solana (SOL) continued its upward trajectory and opened the day with gains of 5.7%.

In weekly performance, SOL also stands out with gains of 28% in the last seven days – the best performance of the Top 10 for the period. Next comes Cardano, with an increase of 19%, and ETH, with 18%. Bitcoin, in turn, has accumulated gains of 8.4% in the last seven days.

Finally, the market value of cryptocurrencies reached US$1.46 trillion (R$7.22 trillion), up 2.3%, and trading volume soared to US$96 billion, up 65%. Bitcoin’s dominance, however, fell to 51.3%, while Ethereum’s rose to 18%, totaling 69.3% of the market.

BlackRock creates ETH trust and boosts market

The strong appreciation of Ethereum occurred after the announcement that BlackRock had created an ETH trust, as reported by CriptoFácil on Thursday (9). The registration does not indicate that the company intends to launch an ETH ETF, but it served to encourage the market and cause the price to rise sharply.

This is because the manager carried out the same movement before requesting the opening of its Bitcoin ETF, which indicates that BlackRock can do the same with Ether. But for now, there are no signs that the United States Securities and Exchange Commission (SEC) intends to approve Ethereum ETFs.

As for the other cryptocurrencies in the Top 100, performance was mixed, with 58 of them recording gains in the last 24 hours. The best performance was with Rocket Pool (RPL), whose price jumped 21.5%, and the Lido network token (LDO), which increased by 19%. The Trust Wallet token (TWT) fell 10.2% and had the worst performance of the day, followed by Injective (INJ), which lost 9% of its value.

Futures and settlements

In addition to the spot market, volumes in the futures market also rose sharply in the last 24 hours. More precisely, an increase of 77% according to data from Coinglass, which led to the market moving more than US$205 billion. Of this amount, Binance accounted for US$28.4 billion, followed by OKX, which generated US$12 billion.

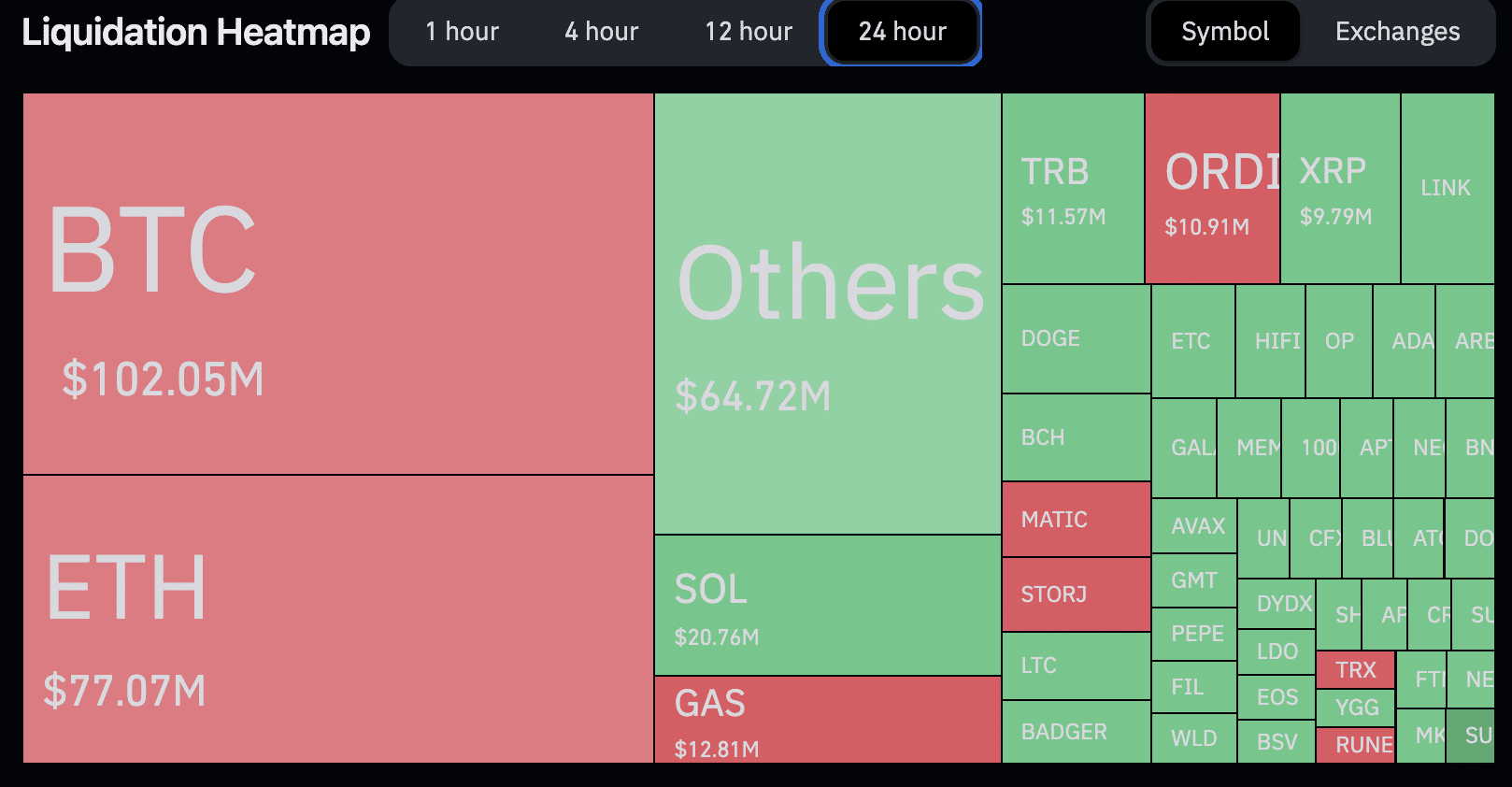

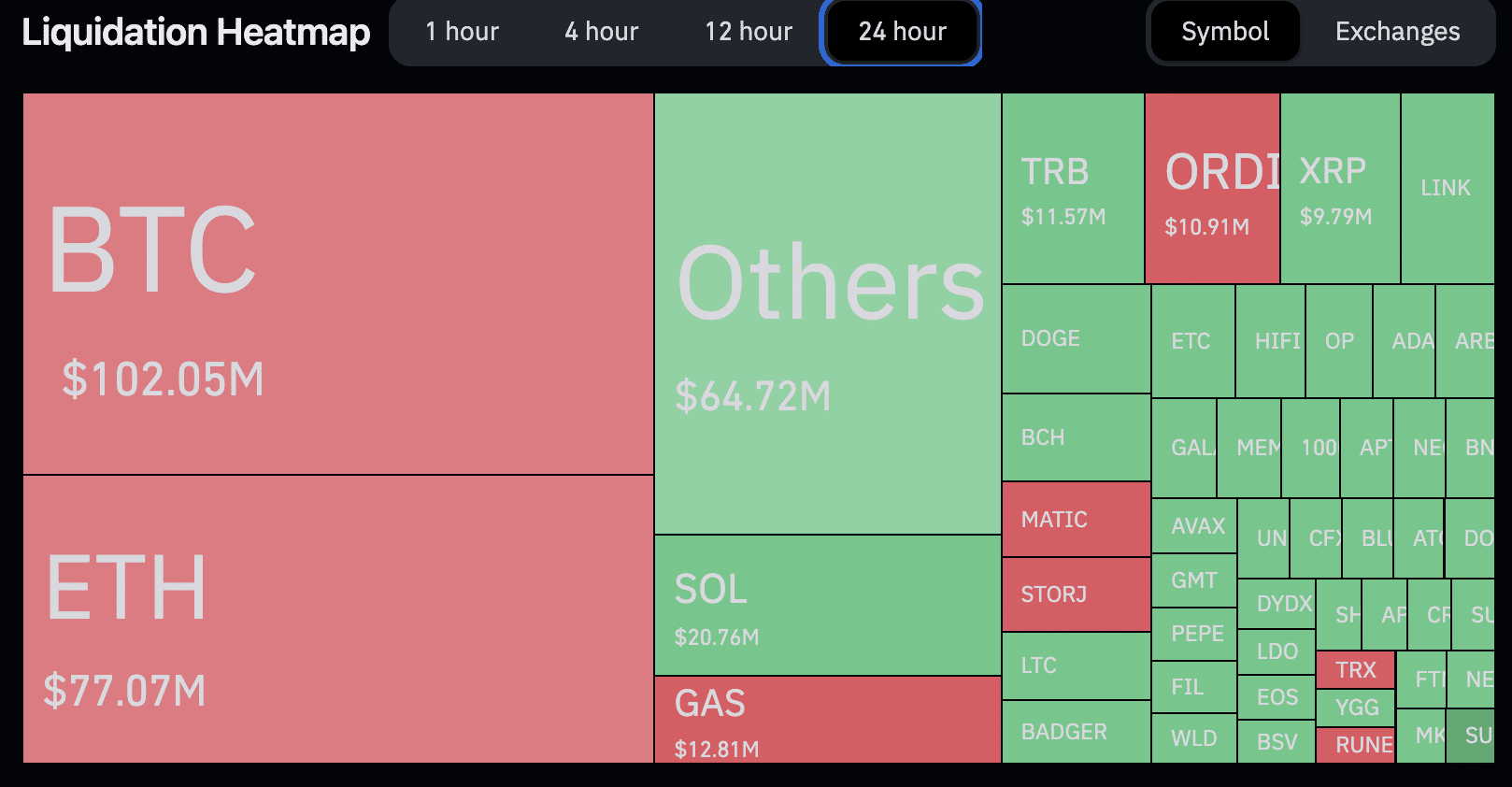

And the return of BTC to the US$37,000 region increased liquidations, especially among those who bet on the price falling. Total volume grew 118% and raised $417 million, but most of it came from long positions, which liquidated $227 million. However, traders who bet on BTC falling lost US$102 million in the last 24 hours.

Source: https://www.criptofacil.com/ethereum-dispara-com-possivel-etf-e-bitcoin-se-recupera/