In 2024, Ethereum (ETH) will already accumulate gains of more than 60%, only in dollar terms. When it comes to the price of ETH in Bitcoin (BTC), the scenario is one of constant decline over the last three years. In fact, ETH even presented a “Death Cross” on its BTC quote.

On Binance, the ETH/BTC pair fell to 0.04563 on Wednesday (15), reaching the lowest level since April 2021. In 2024 alone, the value of ETH quoted in BTC fell by almost 16%, reinforcing the prevalence of Bitcoin over altcoins.

Furthermore, Ethereum experienced a decline in demand for several of its services, losing ground to competitors such as Solana (SOL). Another factor that triggered these losses was pessimism regarding the approval of an Ethereum ETF.

Ethereum Funds Suffer Losses

According to Bloomberg data cited by the ETC Group in its weekly report, global ETH funds, the famous ETPs, recorded net outflows of around US$63.5 million last week. As for ETFs, those listed in Hong Kong saw the biggest outflows.

Meanwhile, Bitcoin ETPs, including US-listed ETFs, raised $92.5 million. This reinforces the growth trend of BTC, which always supplants altcoins at this stage.

Several factors, including lingering uncertainty over the approval of an Ethereum ETF in the US, are likely responsible for the price drop.

“The approval of a spot Bitcoin ETF in the US reinforced Bitcoin’s store of value narrative and its status as a safe haven asset. On the other hand, open questions remain about the fundamental positioning of ETH, whether it is a commodity or a security,” said David Han, research analyst at Coinbase Institutional.

This dispute is part of the US Securities and Exchange Commission’s (SEC) decision regarding the status of ETH. The lack of a definition tends to hinder the advancement of ETFs, which harms the price of the cryptocurrency.

Solana Competition

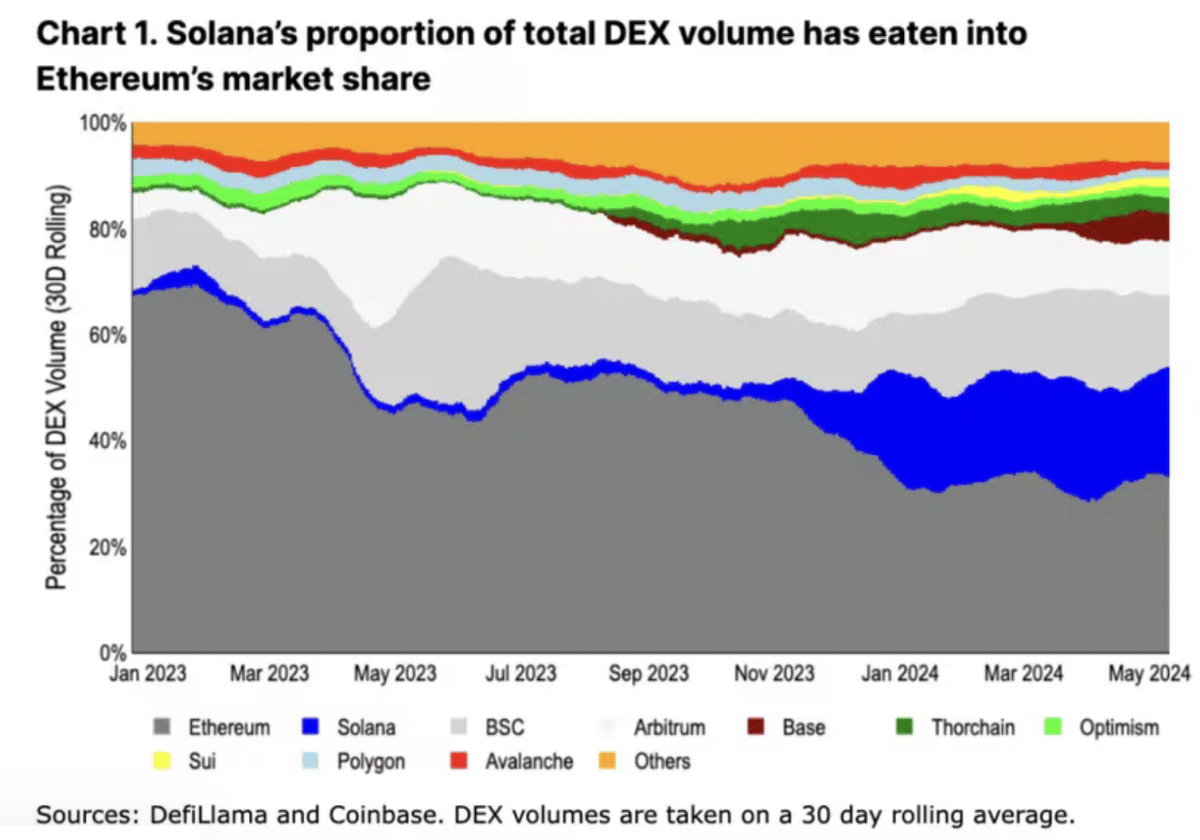

Another warning point raised by Han is Ethereum’s competition with other networks, mainly Solana.

“Competition from layer 1s (L1s), such as Solana, undermines Ethereum’s positioning as the ‘preferred’ network for deploying decentralized applications (dApp),” he explained.

According to data from DeFi Llama, Solana’s share of the total volume of decentralized exchanges (DEX) grew 10 times in one year, from 2% to 21%. Ethereum, which once had 70% of the total DEX volume, today has less than 40%.

Source: https://www.criptofacil.com/ethereum-cotacao-eth-btc-chega-ao-seu-menor-nivel-em-tres-anos/