As Bitcoin (BTC) struggles to maintain its momentum and overcome a lateralization that has lasted more than three months, Peter Schiff has raised alarms about potential market manipulation by hedge funds.

According to Schiff, these financial giants may be involved in negotiations that could affect the stability of Bitcoin and seriously impact MicroStrategy’s financial situation. The company has the largest BTC cash among listed companies and announced the issuance of US$700 million in debt to buy more BTC.

To support his claim, Schiff points out that the 11 Bitcoin ETFs are the main source of this manipulation, with supposed scheduled sales aimed at preventing the price from appreciating.

Warning about funds against Bitcoin

Peter Schiff points to a disturbing pattern that points to a lack of evolution in BTC. This pattern consists of the fact that the cryptocurrency continues to undergo a strong correction, despite the constant flow of purchases from the 11 ETFs.

In this sense, Schiff points out that the fact that Bitcoin’s value remains suppressed is something created deliberately, signaling a possible orchestrated sale.

This scenario leads to questions about BTC’s behavior in the market, especially if these ETF investors start to pull back. If this happens, Schiff points out that another manipulation agent would enter the market: hedge funds.

If ETF demand falls, investors can buy Bitcoin directly or via ETFs as part of a strategic position. But these purchases would not be aimed at long-term investment, but rather a ploy to short sell MicroStrategy shares.

This strategy could be paving the way for a broader restructuring of the market. If hedge funds begin to reverse their positions, they will initiate a cascade of Bitcoin sell orders.

This flow of sell orders would likely cause the price of Bitcoin to plummet, affecting MicroStrategy shares. Hedge funds would profit heavily from short sales to the detriment of shareholders and investors, who would lose money both from the fall in BTC and the devaluation of the company’s shares.

Strong increase in volatility

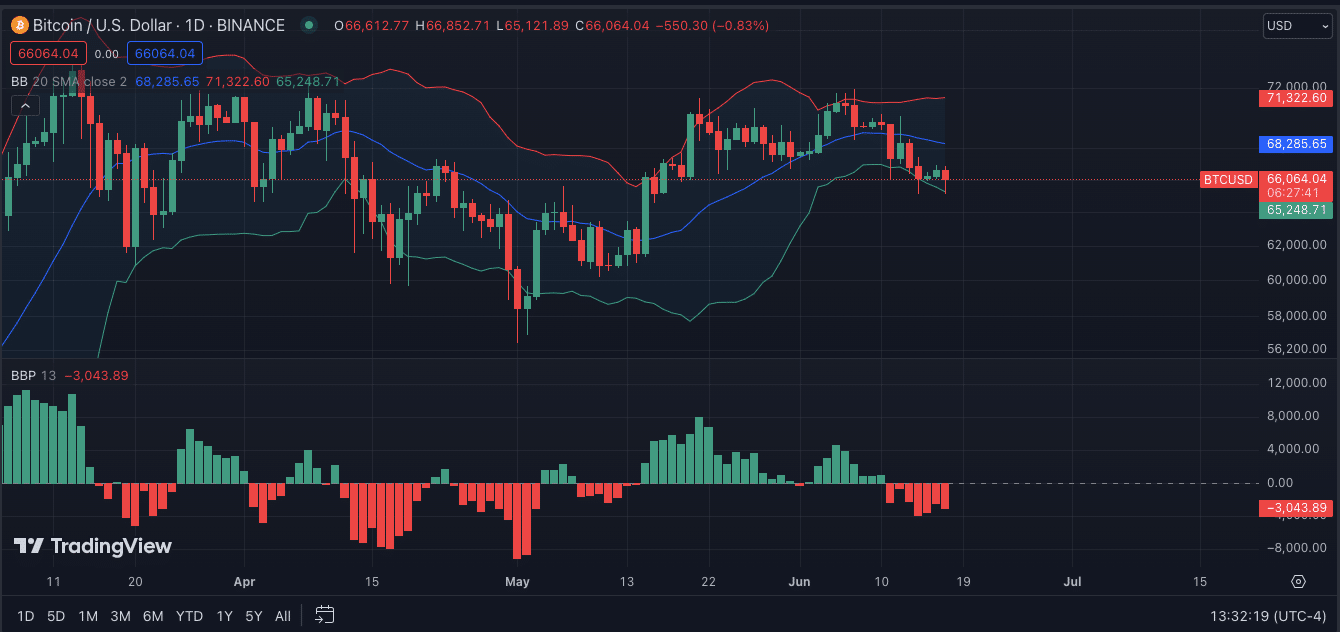

Current technical analysis supports the notion of a significant movement in Bitcoin volatility. The Bollinger Bands on BTC’s 24-hour chart continue to contract – a phenomenon typically indicative of future volatility. Bitcoin price hovers near the lower Bollinger band, suggesting the asset may be undervalued.

Furthermore, the Bull Bear Power (BBP) indicator remains negative, pointing to the dominance of bearish sentiment in the market. This indicator shows that bearish forces push the price towards lower support levels.

However, traders remain alert for any changes in momentum that could signal a reversal. Such reversals are critical as they often precede large market moves and can indicate a recovery or further decline.

Source: https://www.criptofacil.com/etfs-trabalham-para-colapsar-bitcoin-e-microstrategy-diz-peter-schiff/