During the night, the price of Bitcoin (BTC) rose sharply again and broke another price barrier. According to CoinGecko, the cryptocurrency registered gains of 4% this Thursday (9), which made the price reach US$36,700. In Brazil, Bitcoin rose 4.5% and surpassed the R$182,000 region.

As happened on Wednesday (8), the rise in Bitcoin boosted most of the largest cryptocurrencies. In the Top 10, for example, Solana (SOL) soared 8.2% and recorded the biggest increase of the day, followed by Cardano with 4.5%. On the other hand, Ether (ETH) appreciated 1.3% and opened the day at US$ 1,906, while in Brazil the price rose 2% and reached R$ 9,353.

The Top 100 saw more than 90% appreciation, with at least five of them exceeding 10%. Illuvium (ILV) and Kaspa (KAS) were the biggest highlights, with increases of 30% and 22%, respectively. Then came NEO, which rose 14% and MINA, with an increase of 13.3%.

Among the devaluations, only the Uniswap token (UNI) had a significant drop, opening the day with a loss of 1%.

No cryptocurrency in the Top 10 recorded losses. The market value of cryptocurrencies rose 3.1% and reached US$1.42 trillion (R$7 trillion), while the trading volume increased by 29% and reached US$58 billion. Bitcoin’s dominance stood at 52.2% and Ethereum’s (ETH) fell to 16.7%, totaling 68.9% of the market.

‘ETF Window’ moved the market

The significant appreciation of Bitcoin occurred after James Seyyfart, senior ETF analyst at Bloomberg, said that there is a brief window for the United States Securities and Exchange Commission (SEC) to approve all 12 Bitcoin spot ETFs.

According to Seyyfart, this window should open next Friday, November 10th and should last a week. This is the first time the window has opened again after Grayscale’s victory against the SEC.

“This window for all 12 ETFs ends on 11/17. But theoretically, the SEC could make a decision on the top nine on this list at any time before January 10, 2024,” he added.

Financial lawyer Scott Jhonson was less optimistic. He stated that even if the SEC approves the ETF now, it should take at least a month before the fund is launched.

To further clarify this issue, Seyfarrt highlighted the need to complete two essential steps for launching an ETF. The first is the endorsement of the SEC, while the second is the approval of the fund by the Division of Corporate Finance. There is currently no indication that the last step has been completed.

In terms of price, Fernando Pereira, from Bitget, highlights the break of US$36,000, but warns that there is still a chance of further corrections.

“Bitcoin will definitely try to break the $36,000 resistance today. If it closes the day above this price, $40,000 is the target. But we must keep an eye on behavior during the day, if it returns all the rise in the morning (this is normal), we will have the US$32,000 region as our target again”, he said.

Futures and settlements

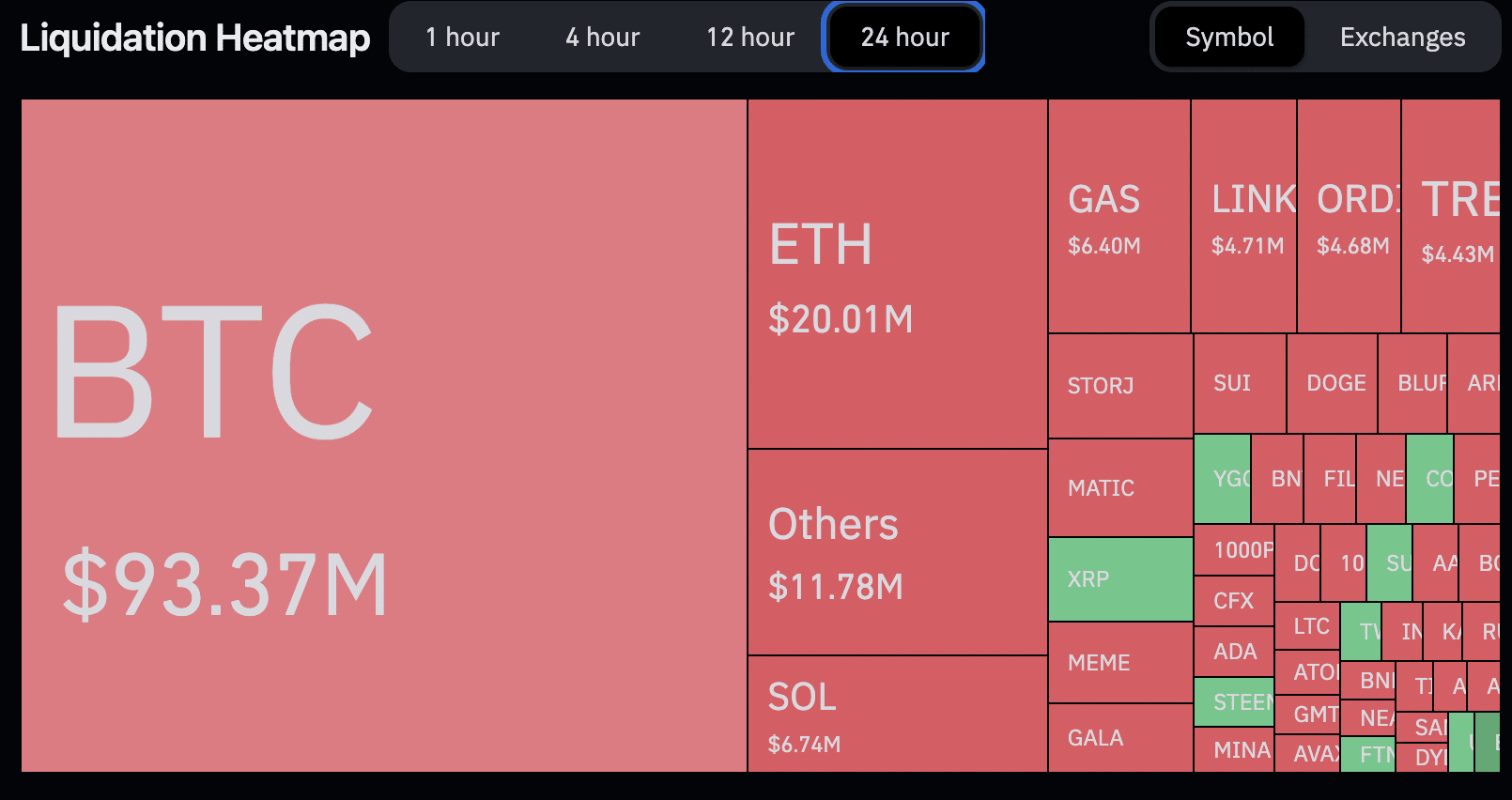

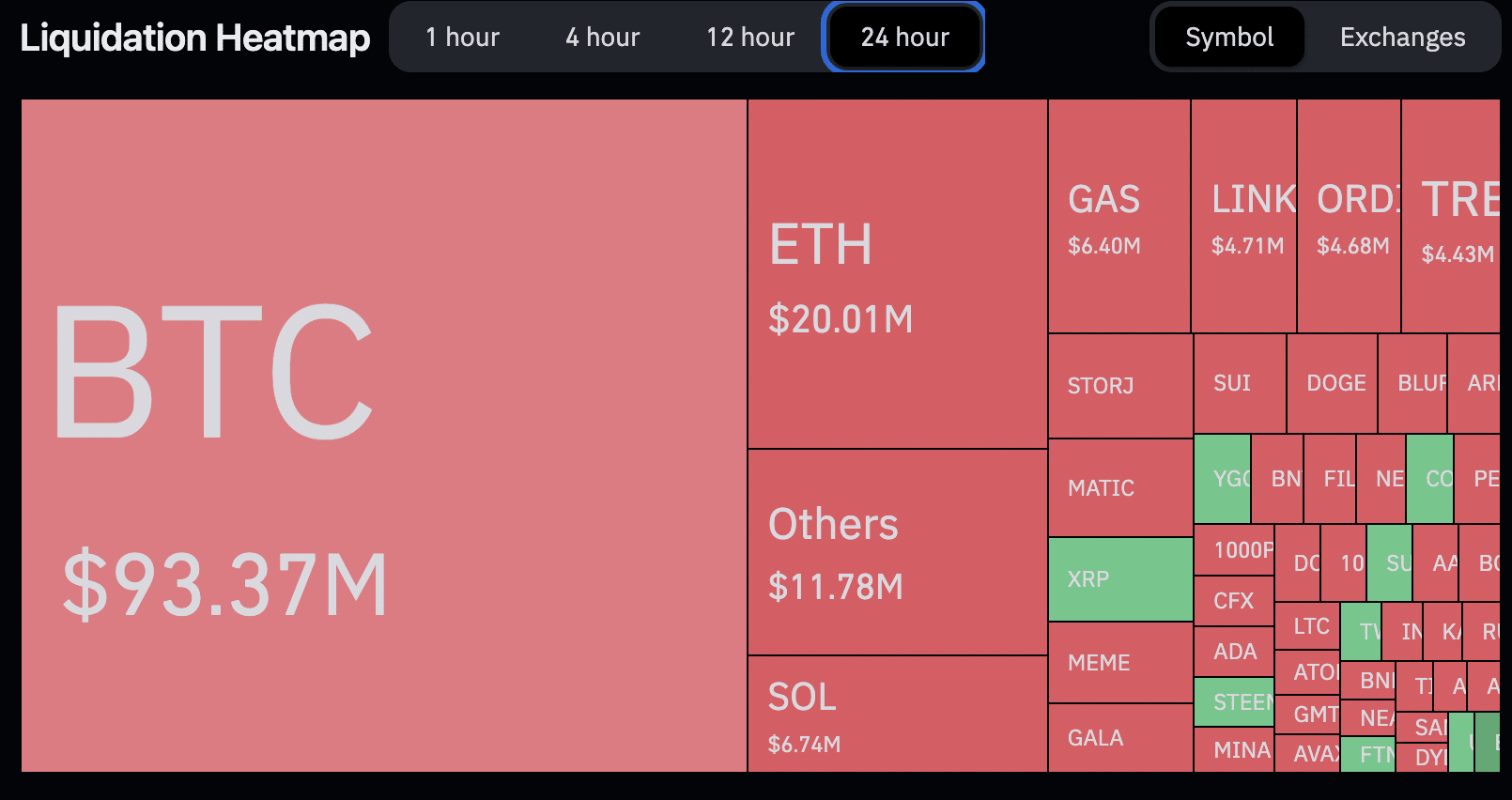

With the rise in the price of Bitcoin, futures and settlement volumes rose sharply again in the last 24 hours. According to the Coinglass website, the futures market moved more than US$114 million, an increase of 35% in total volume. Binance accounted for a volume of US$21.7 billion and Bitget came next, moving US$9.31 billion.

Liquidations reached the US$190 million mark, an increase of 75%, and US$154 million corresponded to positions that bet on falling prices. Bitcoin led the falls among those sold, who had liquidations of more than US$90 million with the cryptocurrency alone.

Market liquidations hit 60,679 traders with heavy losses, including the largest single liquidation of $14.8 million on a BTC contract traded on OKX.

Source: https://www.criptofacil.com/bitcoin-dispara-para-us-36-000-no-rali-da-madrugada/