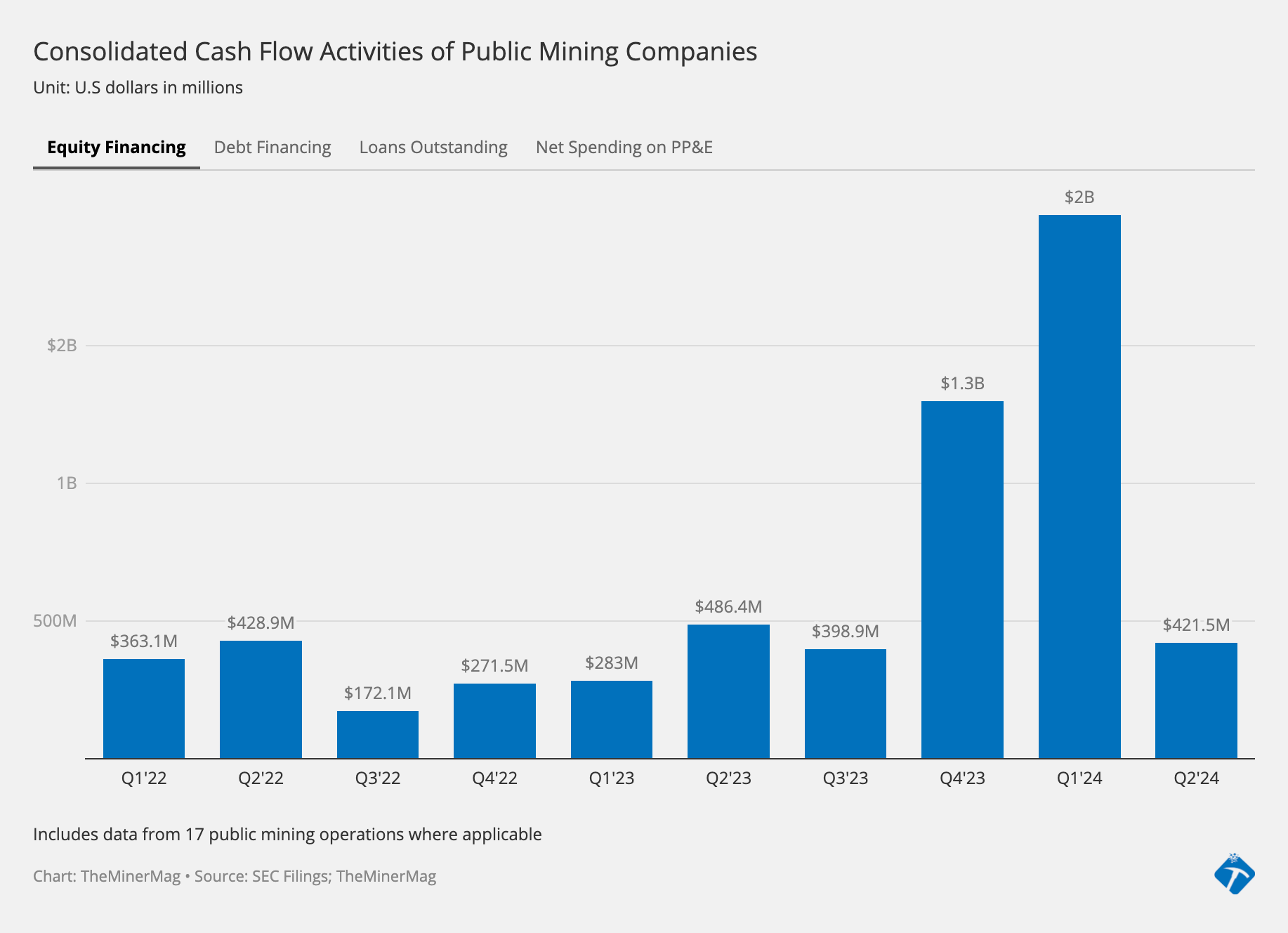

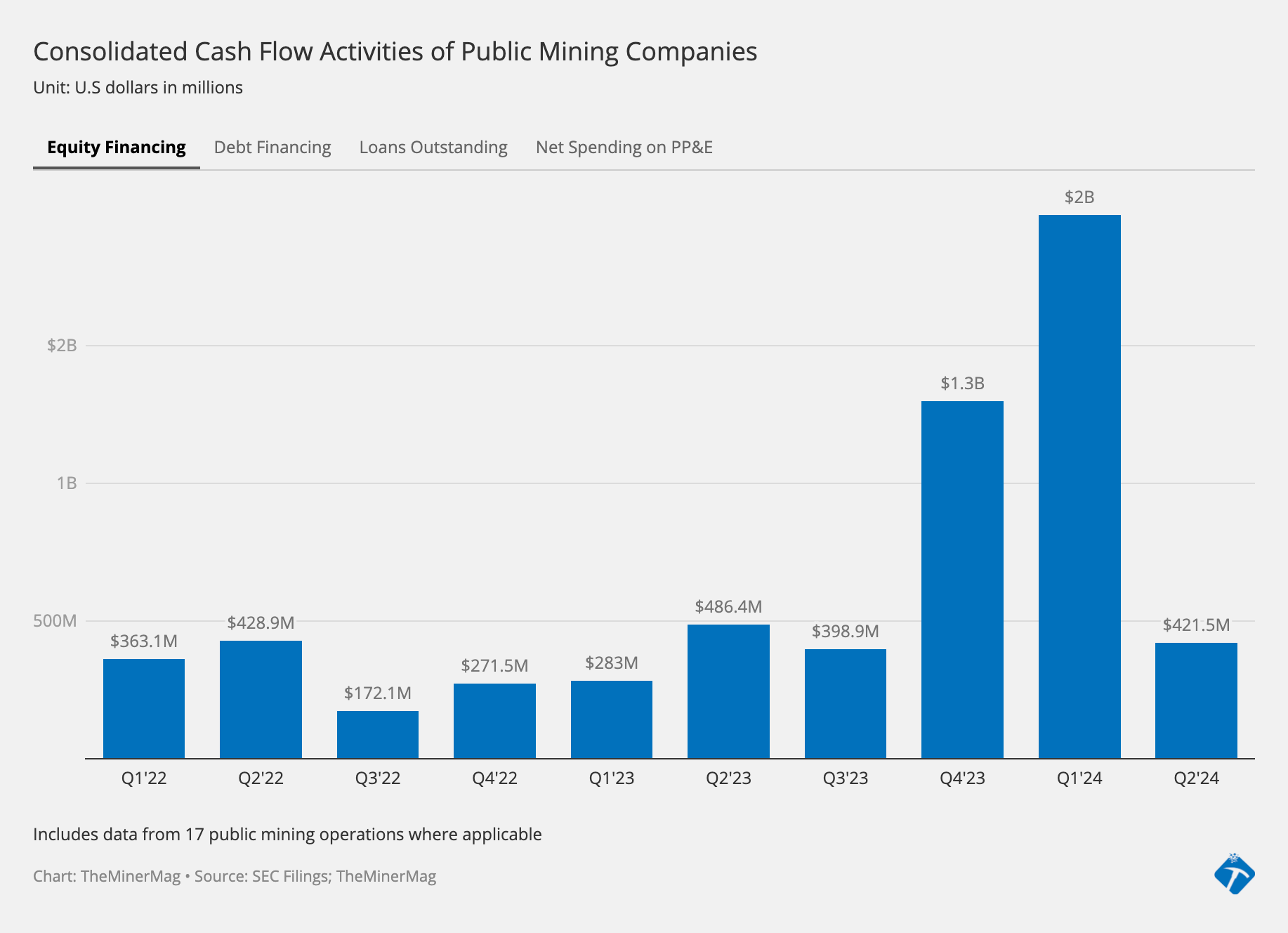

Bitcoin miners raised $2 billion in funding ahead of the Bitcoin halving, which took place in April 2024. This influx of capital reflects companies’ preparation for the expected drop in mining profitability resulting from the halving of mining rewards , an event known as halving.

BlocksBridge Consulting, a cryptocurrency analysis firm, revealed that ten of the top twelve public miners have raised this significant amount to bolster their balance sheets.

The BlocksBridge report indicates that public mining companies have raised a combined total of $2 billion in gross proceeds from equity financing activities. This amount is significantly higher than the US$1.25 billion raised in the last quarter of 2023. Among the companies that raised the most funds are Marathon Digital, CleanSpark and Riot Platforms, which together were responsible for 73% of the capital raised.

Bitcoin Mining Companies

As of the end of March 2024, these three companies held a combined total of $1.33 billion in cash. In addition, the companies also had more than 32,200 Bitcoins, valued at more than US$2.2 billion. This financial strengthening aims to mitigate the effects of the reduction in mining rewards, which occurs approximately every four years and has a direct impact on miners’ profitability.

Equity financing, which involves raising funds by selling company shares to investors, is a crucial tool for Bitcoin mining companies. This method is often used to finance infrastructure, technology upgrades and operational costs, especially in preparation for the Bitcoin halving.

After going public, a company can issue additional shares to raise funds from investors. This is a common practice among mining companies facing the financial challenges associated with halving.

Outlook for the second quarter of 2024

Despite funding in the first quarter, funding activity is expected to decline significantly in the second quarter of 2024.

According to BlocksBridge Consulting, less than $500 million had been invested as of mid-May. “Financing activities appear to have declined since the second quarter,” the report stated. However, even decreasing, this value already exceeds that recorded in the third quarter of the previous year.

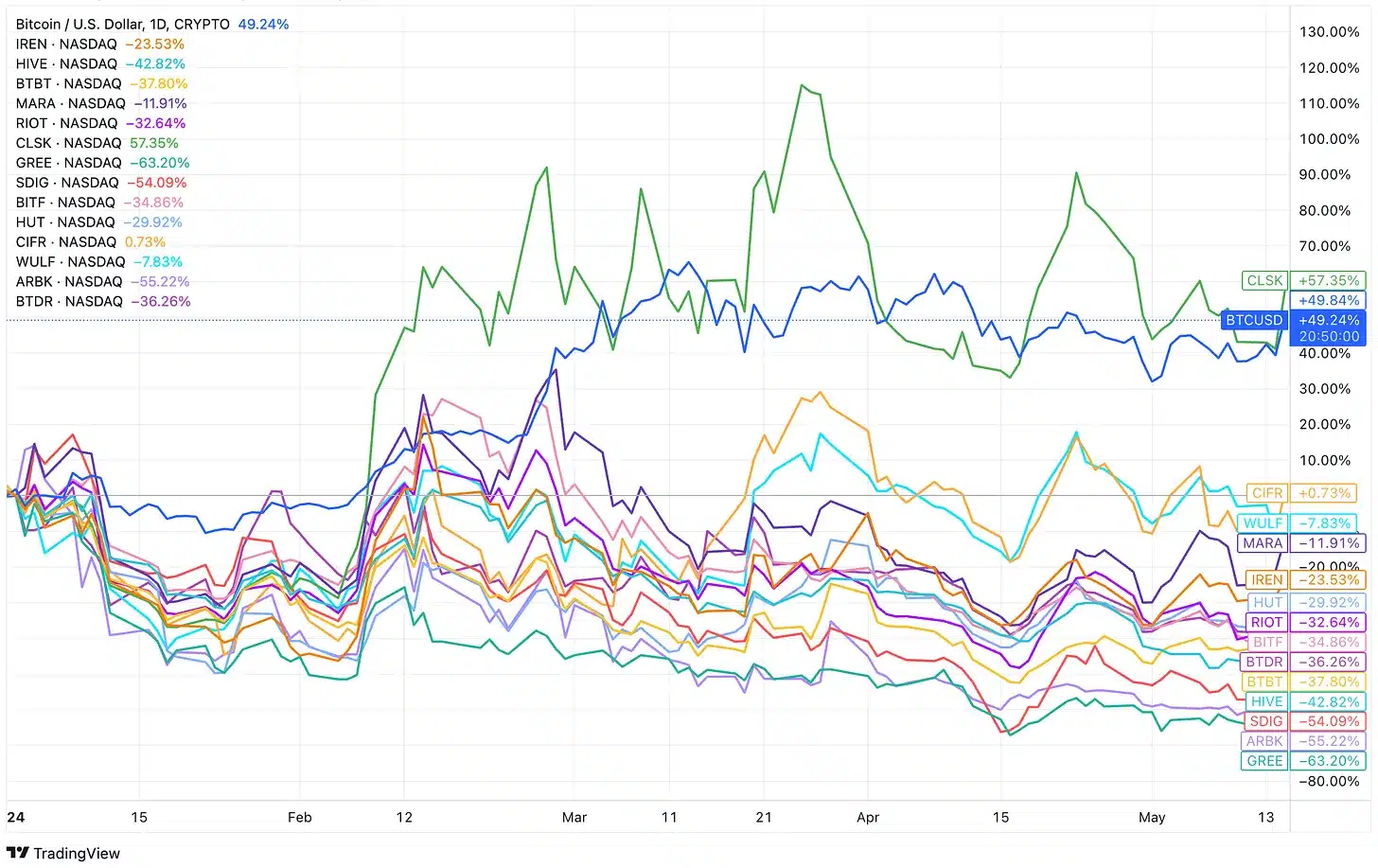

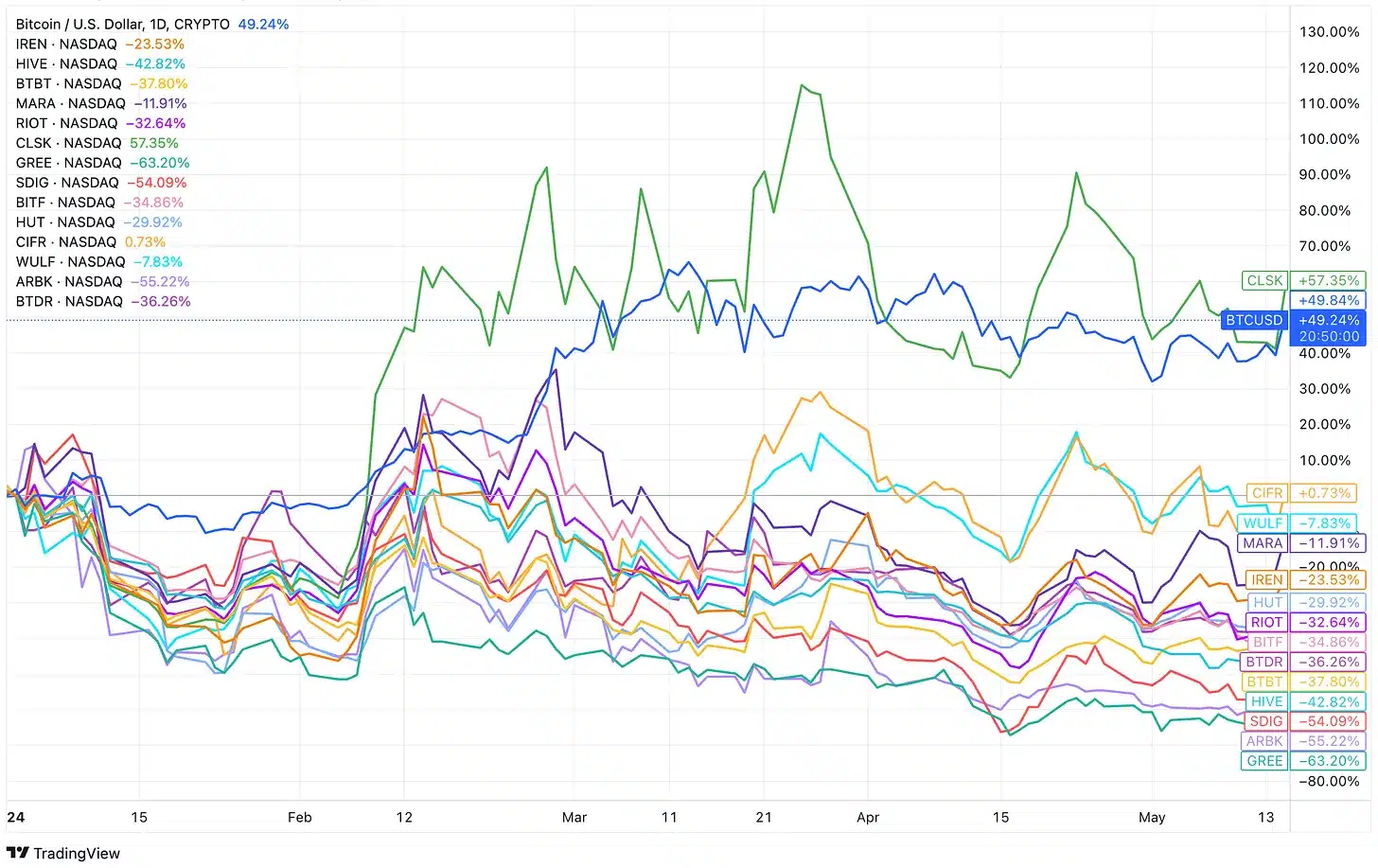

In the first quarter of 2024, Bitcoin mining companies reported low financial results, influenced by Bitcoin prices and rising mining costs. Riot Platforms, for example, recorded record net revenue of US$211.8 million.

This number represents a 1,000% increase compared to the same period last year. Despite the significant increase in revenue, the company failed to meet analysts’ forecasts due to high mining costs and decreased Bitcoin production.

Post-halving difficulties

Core Scientific, which recently emerged from bankruptcy, reported revenue of $179.3 million in the first quarter of 2024. The company was able to exceed its mining costs, which were $68.4 million, resulting in a gross margin of 46%. This performance indicates a substantial recovery for Core Scientific after facing financial difficulties.

On the other hand, Marathon Digital faced significant challenges, citing bad weather and equipment failures as reasons for missing Wall Street analysts’ revenue estimates. However, the company reported a 223% year-over-year increase in revenue, totaling $165.2 million.

Source: https://www.criptofacil.com/mineradoras-de-bitcoin-receberam-us-2-bilhoes-em-financiamento-antes-do-halving/