Smart contract platform Algorand (ALGO) has stood out with remarkable performance. Exceeding the general expectations of the cryptocurrency market, Algorand recorded impressive growth in the fourth quarter of 2023, as reported by Messari.

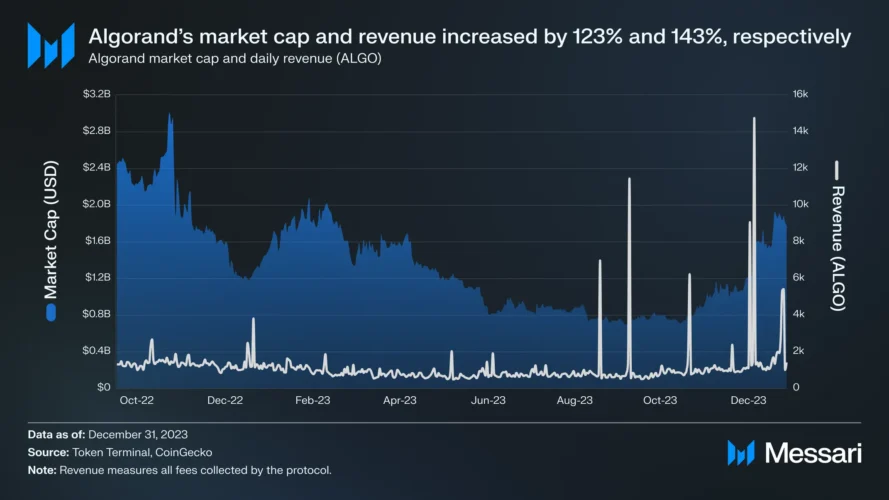

This period was marked by a considerable increase in Algorand’s market capitalization, which achieved significant growth of 123%. This jump was in part driven by the positive momentum of the cryptocurrency market as a whole, which saw a 53% increase in market capitalization in the same interval.

One of the crucial factors for this growth was the notable increase in transactions on the Algorand network, which grew 58% compared to the previous quarter. Fee revenues followed this trend, with an increase of 60% in ALGO terms and an impressive 143% in US dollars, marking the highest point of the year.

Messari’s report points to Algorand’s “thriving” ecosystem as one of the main drivers of this success. During the fourth quarter, the platform witnessed the launch of several innovative applications, covering areas such as programmable and regulated euro, agricultural land tokenization, and a marketplace for selling code snippets. These innovations reinforce Algorand’s image as a dynamic and versatile platform.

In the same period, user adoption on Algorand soared, with the addition of 1.9 million new addresses, a quarterly growth of 72%. Additionally, transaction volume reached a peak of 5.5 million at the end of the quarter, the highest number recorded in the year, with ALGO transactions increasing 43%.

Despite growth on multiple fronts, the amount of ALGO staked has declined 49% year-over-year, a trend attributed to reduced governance rewards. This decline suggests a preference among users to use the asset for transactions rather than committing it to governance.

At the same time, there was a drop in the market capitalization of Algorand’s stablecoin, with a reduction of 43% in the quarter and 74% annually. While Tether’s USDT stablecoin faced a sharp drop on Algorand, Quantoz introduced EURD, contributing 1.4% of the stablecoin’s market capitalization on the platform.

In contrast to these decreases, Algorand’s total value locked (TVL) in decentralized finance (DeFi) saw a 109% increase in Q4, demonstrating the platform’s resilience and adaptability.

At the time of publication, the price of the ALGO cryptocurrency was quoted at US$0.171 with a drop of 3% in the last 24 hours.

Disclaimer:

The views and opinions expressed by the author, or anyone mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing or trading cryptocurrencies carries a risk of financial loss.

Source: https://portalcripto.com.br/algorand-algo-brilha-com-crescimento-exponencial-e-inovacoes-no-quarto-trimestre-de-2023/