In the Bitcoin scene, a digital euro (CBDC) is seen as a specter of monetary totalitarianism, against which only free electronic money like Bitcoin protects. With Joana Cotar, this debate recently reached the Bundestag. But it only has a limited connection with reality.

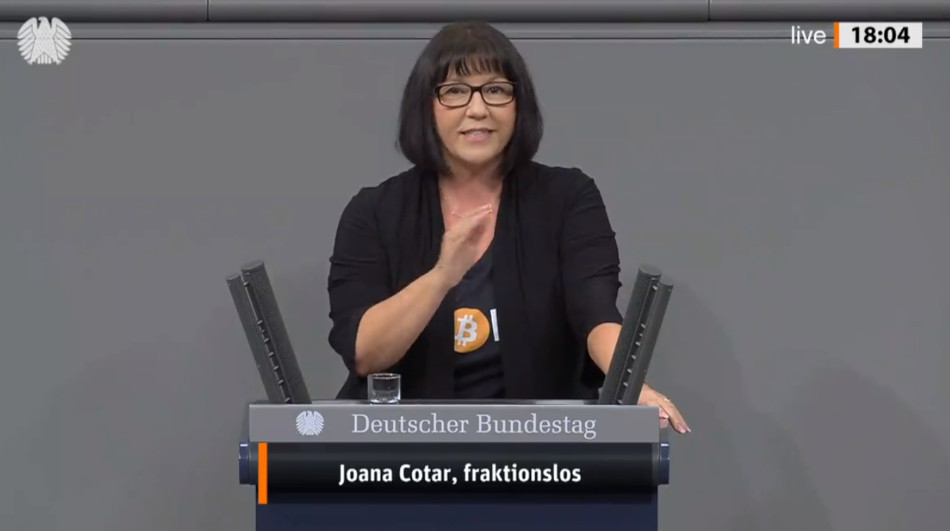

Recently, the independent Bitcoin MP Joana Cotar gave a short speech about CBDC in the Bundestag. CBDC is the abbreviation for “Central Bank Digital Currency”, i.e. digital fiat money, and in this context means a digital euro issued by the ECB.

Ms. Cotar’s speech received euphoric applause in the Bitcoin scene. It received international attention and was even translated into other languages. There was some criticism that the ex-AfD politician did not differentiate herself sufficiently from right-wing extremism. But even this criticism acknowledged that her speech hit the nail on the head.

But does she? Honestly, not really. Because it is above all a ghost debate that presents Bitcoin as a solution to a problem that doesn’t even exist.

“It’s called social scoring, and it’s easily possible here with the digital euro.”

Nobody needs the digital euro, says Ms. Cotar, except the ECB and the politicians who want “total surveillance”. The ECB does promise data protection, but this is just as valuable as the promises made when the euro was introduced, for example that there would be no bailouts.

In China, the government is already using the digital yuan to control citizens. Only those who behave in accordance with the state have access to their money. “It’s called social scoring, and it’s easily possible here with the digital euro.” Joana Cotar paints a dystopian picture of surveillance: When you book a flight, it is checked whether you still have CO2 credits, a payment in a restaurant is only approved if you are vaccinated, and donations to inconvenient organizations are simply withheld.

In short: It is “a digital nightmare”, which is why there is no need for a vote on “how”, but rather the Bundestag should completely reject the digital euro project.

How does the digital euro change the status quo?

Of course, such a vision of controlled payments is dystopian, and of course Bitcoiners would do well to reject it too soon rather than too late.

However, it is difficult to understand why exactly the digital euro should create this dystopia. All electronic euro transactions are already monitored when they are carried out through banks and other intermediaries. These service providers carry out ongoing anti-money laundering measures and attach data about the sender and recipient to every transaction. That’s why Bitcoin and other cryptocurrencies exist.

One could say that a digital euro would make monitoring and control more efficient. All data was centralized and received by the ECB. It would then no longer be dependent on the cooperation of service providers, neither to monitor nor to block. But for this to be true, the EU would have to ban all other payment methods parallel to the introduction of the digital euro – which is an extremely unlikely prospect. Such a ban would hardly make it through the EU’s democratic procedures, and even then it would not be enforceable with cryptocurrencies. That is precisely the strength of Bitcoin.

In general, the payer’s maneuvering as outlined by Ms. Cotar means that numerous European rights are undermined. The European Union, although worthy of criticism in many respects but hardly autocratic, would have to show its tyrannical face for this to happen. The EU would have to become a new China that blocks all other payment methods, possibly a second North Korea. This is also not apparent yet.

The slippery road

If, like Ms. Cotar – and large parts of the Bitcoin community – you reject a digital euro because you fear that the EU would misuse it for its autocratic ambitions, you are heading down a slippery path.

Shouldn’t we then reject the EU completely? Nip any digitalization of public administration in the bud? Would any kind of modernization of the state be permissible at all, since this also modernizes oppression? Wouldn’t it have been a mistake to introduce email and the Internet since states have access to the infrastructure?

As important as it is to take early action against autocratic tendencies that disempower citizens, anyone who only measures technologies based on what a hypothetical tyranny would do to them is less a defender of freedom than an opponent of progress. Bitcoiners would do better to sharpen the potential of their own technology instead of advocating forbidding the competition from further technical development.

In principle not wrong

In any case, the plans for a digital euro are not yet beyond rough drafts. The ECB has not even come up with a suitable concept. After talking about the digital euro for years, it agreed in mid-October to enter the “preparation phase,” which explicitly does not represent a decision to introduce it.

So it will still be years before a digital euro is functional. If at all. And even then, it is questionable whether it will be successful in the payment market rather than finding the expected place alongside the digital driver’s license and DeMail. If the EU were not to take the North Korean route and ban every other means of payment, a digital euro would have to have significant advantages over competition from PayPal, credit cards, stablecoins and more, such as the promised privacy, in order not to become a non-starter.

If the ECB were to realize such advantages, the digital euro would simply offer the market one more option. And in principle there is nothing wrong with that. But even that probably remains a ghost debate.

Source: https://bitcoinblog.de/2023/11/14/cbdc-eine-geisterdebatte-ueber-den-digitalen-euro/